© Westend61/Getty Images Man using a banking app on phone

A certificate of deposit (CD) is a time deposit account. Chumba free 100. A bank agrees to pay interest at a certain rate if savers deposit their cash for a set term, or period of time.

Current Deposit Rates for -. Savings Accounts: Annual Percentage Yields and Interest Rates shown are offered on accounts accepted by the Bank and effective for the dates shown above, unless otherwise noted. Interest Rates are subject to change without notice. Interest is compounded daily and paid monthly. There is a penalty for withdrawing principal prior to the maturity date. For Personal CDs: If the term of the CD is less than 6 months, the early withdrawal penalty is 90 days of interest on the amount withdrawn, but not more than the total amount of interest earned during the current term of the CD.

Popular Searches

Find current CD rates and recent interest rate trends from Bankrate below. Here are the current average rates for the week of March 3:

- 1-year CD rates: 0.19%

- 5-year CD rates: 0.32%

- 1-year jumbo CD rates: 0.21%

- 5-year jumbo CD rates: 0.33%

- Money market account rates: 0.08%

Since the Federal Reserve lowered the fed funds ratetwice last March, CD and money market account (MMA) rates have been declining at many banks. Declining Treasurys may also cause CD rates to decrease.

Latest CD rates: 3-month trend

| Date | 1-year CD | 5-year CD | 1-year jumbo | 5-year jumbo | Money market account |

|---|---|---|---|---|---|

| 03/03/2021 | 0.19% | 0.32% | 0.21% | 0.33% | 0.08% |

| 02/24/2021 | 0.20% | 0.33% | 0.21% | 0.34% | 0.08% |

| 02/17/2021 | 0.19% | 0.33% | 0.21% | 0.34% | 0.08% |

| 02/10/2021 | 0.19% | 0.33% | 0.22% | 0.34% | 0.08% |

| 02/03/2021 | 0.20% | 0.34% | 0.22% | 0.35% | 0.08% |

| 01/27/2021 | 0.20% | 0.35% | 0.23% | 0.36% | 0.08% |

| 01/20/2021 | 0.21% | 0.35% | 0.23% | 0.36% | 0.09% |

| 01/13/2021 | 0.21% | 0.36% | 0.23% | 0.37% | 0.09% |

| 01/06/2021 | 0.21% | 0.36% | 0.23% | 0.37% | 0.09% |

| 12/30/2020 | 0.22% | 0.37% | 0.24% | 0.38% | 0.09% |

| 12/23/2020 | 0.22% | 0.38% | 0.24% | 0.39% | 0.09% |

| 12/16/2020 | 0.23% | 0.39% | 0.25% | 0.40% | 0.09% |

| 12/9/2020 | 0.24% | 0.40% | 0.26% | 0.41% | 0.10% |

| 12/2/2020 | 0.24% | 0.40% | 0.26% | 0.41% | 0.10% |

| 11/25/2020 | 0.24% | 0.41% | 0.26% | 0.42% | 0.10% |

No need to stick to low rates: Below are some of the best CD rates from popular banks by term

Compare current CD rates by term for March 2021

Current CD rates: 6-month

- Quontic Bank: 0.60% APY

- Limelight Bank: 0.50% APY

- First Internet Bank: 0.45% APY

- Bethpage Federal Credit Union: 0.40% APY

- EmigrantDirect: 0.35% APY

Current CD rates: 1-year

- Quontic Bank: 0.65% APY

- Live Oak Bank: 0.65% APY

- Ally Bank: 0.60% APY

- BrioDirect: 0.60% APY

- Synchrony Bank: 0.55% APY

Current CD rates: 3-year

- Delta Community Credit Union: 1.05% APY

- Comenity Direct: 0.85% APY

- Salem Five Direct: 0.75% APY

- Navy Federal Credit Union: 0.70% APY

- TIAA Bank: 0.70% APY

Current CD rates: 5-year

- Delta Community Credit Union: 1.25% APY

- SchoolsFirst Federal Credit Union: 1.01% APY

- VyStar Credit Union: 1.00% APY

- Suncoast Credit Union: 0.95% APY

- Ally Bank: 0.85% APY

Note: The APYs (Annual Percentage Yields) shown are as of March 4, 2021.The APYs for some products may vary by region.

Current CD rates FAQs

What are today's CD rates?

According to Bankrate's most recent national survey of banks and thrifts, the average rate for a 1-year CD is 0.19 percent. The average rate for a 5-year CD is 0.32 percent. The average rate for a 1-year jumbo CD is 0.21 percent. The average 5-year jumbo CD rate is 0.33 percent. Nsb fixed deposit rates.

The Federal Reserve and CD rates

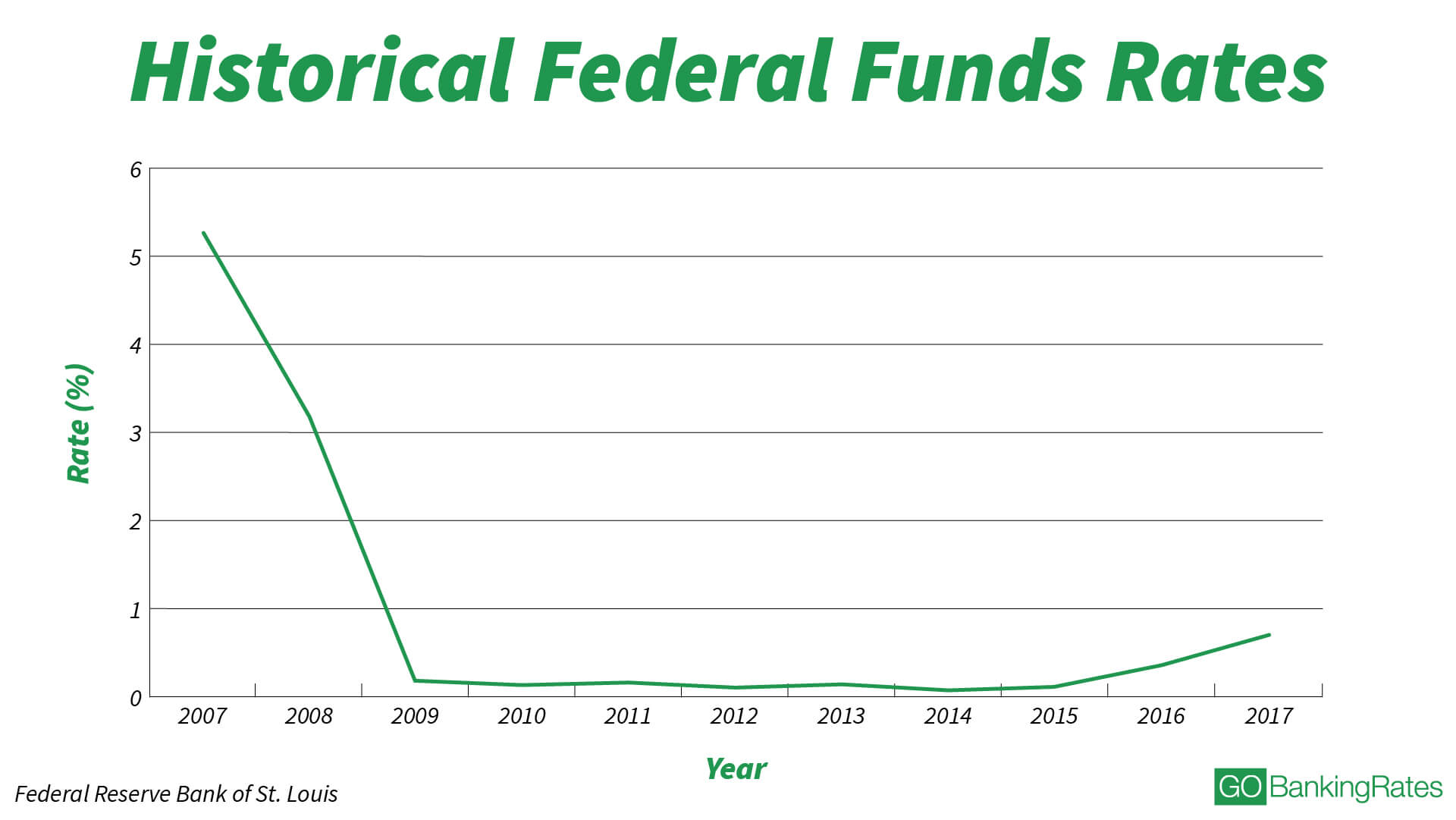

When the Federal Reserve makes interest rate decisions, the rates that banks offer on CDs can change.

The Fed can choose to raise or lower the federal funds rate. Once the central bank makes a decision to change the rate, banks will generally move CD yields in the same direction. Broader macroeconomic conditions also influence CD rates.

CD rates typically follow the direction of the Federal Reserve closely. For example, in 2020, the Fed made two emergency cuts and CD rates have been declining at some banks to protect their profits.

How are CD interest rates determined?

CD rates are determined by several factors. The decisions made by the Federal Reserve on the federal funds rate will influence CD rates.

Competition among banks and credit unions will also influence the payout out on their CDs as well as whether the financial institution needs deposits or not. In general, online banks tend to pay higher rates than banks with branches.

Neosurf france. Changes in Treasury yields and economic conditions also influence CD rates.

Current CD rates: 3-year

- Delta Community Credit Union: 1.05% APY

- Comenity Direct: 0.85% APY

- Salem Five Direct: 0.75% APY

- Navy Federal Credit Union: 0.70% APY

- TIAA Bank: 0.70% APY

Current CD rates: 5-year

- Delta Community Credit Union: 1.25% APY

- SchoolsFirst Federal Credit Union: 1.01% APY

- VyStar Credit Union: 1.00% APY

- Suncoast Credit Union: 0.95% APY

- Ally Bank: 0.85% APY

Note: The APYs (Annual Percentage Yields) shown are as of March 4, 2021.The APYs for some products may vary by region.

Current CD rates FAQs

What are today's CD rates?

According to Bankrate's most recent national survey of banks and thrifts, the average rate for a 1-year CD is 0.19 percent. The average rate for a 5-year CD is 0.32 percent. The average rate for a 1-year jumbo CD is 0.21 percent. The average 5-year jumbo CD rate is 0.33 percent. Nsb fixed deposit rates.

The Federal Reserve and CD rates

When the Federal Reserve makes interest rate decisions, the rates that banks offer on CDs can change.

The Fed can choose to raise or lower the federal funds rate. Once the central bank makes a decision to change the rate, banks will generally move CD yields in the same direction. Broader macroeconomic conditions also influence CD rates.

CD rates typically follow the direction of the Federal Reserve closely. For example, in 2020, the Fed made two emergency cuts and CD rates have been declining at some banks to protect their profits.

How are CD interest rates determined?

CD rates are determined by several factors. The decisions made by the Federal Reserve on the federal funds rate will influence CD rates.

Competition among banks and credit unions will also influence the payout out on their CDs as well as whether the financial institution needs deposits or not. In general, online banks tend to pay higher rates than banks with branches.

Neosurf france. Changes in Treasury yields and economic conditions also influence CD rates.

Learn more:

Learn more about other CD terms:

Advertiser Disclosure |Best Interest Rates On Cds

Certificates of deposit, or CDs, are powerful, interest-bearing investments that reward investors for leaving cash untouched for a fixed period of time. A CD calculator can help you to know how much you can expect to make on your investment and how much to invest to reach your financial goal.

How to calculate CD earnings

Using a CD calculator is simple. Input the basic information about the CD option you're looking at, and click the calculate button. The information you'll need is your initial deposit size, how long the CD is invested for and the APY rate offered.

You can compare different scenarios by changing out these numbers to see the effects it will have on your total ending balance, interest earnings, total earnings and how that matches up against the current national average.

- Initial deposit: The amount of money you initially invest in your CD

- Period (months and years): The time period that your CD is for. This is the period of time you're expected to leave your funds untouched to get maximum gains.

- APY: The annual percentage yield (APY) is the percentage rate of return you'll see over the course of one year. APY, as opposed to the interest rate, does take into account the effects of compound interest.

- Total balance: The amount you should have available for withdrawal at the end of your CD investment term.

- Interest earnings: The portion of your earnings that come from interest

- Your earnings: The total earnings you'll see at the end of your CD term, including interest and the effects of compounding

- National average: The amount you would earn with a CD that mirrored the current national average rate of return

Why use a CD calculator

As long as you're getting a CD through a trusted banking partner that is FDIC insured or NCUA insured, the major difference between options will be the rate of return. CD calculators allow you to quickly determine how much you're going to make with a particular CD option. If you're looking to meet a particular savings goal, a CD calculator lets you quickly change period lengths, deposit amounts and APY rates to find the right option.

How to pick the best CD provider

The first thing you should look for when selecting a CD provider is whether it is FDIC- or NCUA-insured or not. You will want to stick to investing in financial institutions that have government backing of the funds.

From there, you'll want to look at the APY rates to see where you might get the best return. Remember, APY rates will vary based on the term of the CD and also may vary based on the amount of money you have invested. Always take the time to compare the best CD rates to make sure that you're locking your money into the right account.

Lastly, make sure you look at the early withdrawal penalties. Not all institutions assess the same penalties. Ideally, you'll keep the money in the CD until maturity, but it's good to know what will happen if you find a sudden need for the money.

What happens if you withdraw early

Unless you're taking advantage of a no-penalty CD like the ones offered through Ally Bank, you will incur an interest penalty if you withdraw your funds early. The idea of a CD is that the bank knows it can use your funds for different operations during the fixed period. When you withdraw early, the bank will assess a penalty because of this.

12 Month Cd Rates

Different financial institutions will have different withdrawal penalties. For example, Alliant Credit Union will take back the interest earned up to 120 days for a CD that is open 18 to 23 months. Ally Bank will only take up to 60 days of interest for CDs 24 months or less. Keep in mind that the bank or credit union won't take any of your initial deposit as a penalty.